Hey, fellow plebs.

Timing is everything, right?

If, like me, you got into Bitcoin in the last one to two years with the goal of growing your wealth through investing, you've had the great fortune and misfortune to have joined Bitcoin during what has arguably been the most difficult cycle to navigate so far.

The double-peak psyched out many Bitcoin veterans. Never before seen levels of manipulation by Wall Street firms and hedge funds played on (preyed on) human psychology using Wyckoff distribution patterns -- twice! Then the global economy hit the skids due to ongoing supply chain issues and rampant, uncontrolled inflation (which is causing the Fed to tighten, strengthening the US dollar, and killing risk assets like the Nasdaq and Bitcoin). Not even gold is safe from the global "flight to safety", as everyone everywhere sells everything for US dollars. And now we've seen the largest monthly correction in Bitcoin's history (June 2022) and the first time Bitcoin has closed a week below its prior-cycle peak price.

NOTE: The trend behind statements like "no one who has held Bitcoin for over 3.8 years has ever lost money" (which I had in my "These things will always be true" section) are now having to be adjusted out to 4+ years.

Many new Bitcoiners are now underwater (holding "paper losses") and many of them have already sold at a loss.

On the other hand, many long-time Bitcoiners welcome this bear market as a time to flush the excess leverage, greed, and worthless shitcoins out of the system. The last several months have indeed flushed out pretty much all of the "tourists" (folks who were just trying to make a quick buck and never took the time to learn the significance of what it is they were trading).

The lying liars behind Terra/LUNA, Three Arrows Capital, Celsius, and Voyager are getting flushed out of the system.

✨ 🌈 The market is healing!!! 🌈 ✨

And yet, if we zoom out, all of this becomes noise. It is not market capitalization but adoption that is the tectonic force that drives new technologies.

Here's Blockware's forecast for global Bitcoin adoption as of June, 2022:

-- Blockware Solutions, June 2002

I don't know that I'll be lucky enough to still be here in 2102, but I hope I'll still be here in 2052.

So if you're reading this in 2022 (or even 2026!), you're still incredibly early.

And if you've been hodling any bitcoin that you've held for at least 5 months (155 days), congratulations! You're statistically categorized as a "long-term holder" (according to Glassnode's on-chain analysis) and you've survived all of the above volatility and chaos! Seriously, congrats. Give yourself a pat on the back. You've got what it takes to hang in through the most gruesome selloffs, ignore the price, and keep accumulating the best asset ever devised!

Hopefully you've listened to my "always" provisos about not investing more than you can afford to lose, thinking of it as a long-term (minimum 4-year) investment, and dollar-cost averaging at a reasonable rate. If you've done those things, then you were likely well positioned for this bear market.

Not investing more than you can afford to lose will help you remain calm and avoid the panic and fear response to sell at a loss.

Thinking of it as a long-term investment will help you to ignore the price volatility and focus on the long-term outlook (fundamentals like adoption, network strength, the evolving technology, etc.).

Dollar-cost averaging will have automatically kept your purchases (in sats) smaller at the higher prices and larger at the lower prices... and means you maybe didn't go "all in" yet so you have the ability to stack even more sats at these bargain basement, bear market prices.

I firmly believe that when we look back in ten years, stacking sats consistently through this bear market will be one of the best investments you've ever made.

As workers struggling against persistent, high inflation, while our governments are intentionally using that inflation to steal our collective wealth (a kind of "stealth tax"), and where violent revolution is unpalatable for most and infeasible against the state's monopoly on violence, Bitcoin represents a way for us to simply opt out and choose a new monetary system where fairness (non-discrimination, open access) is baked into the money technology itself.

But is Bitcoin really fair? How fair can it be when the wealth distribution of Bitcoin is so skewed toward the rich? Won't the age-old pattern of "the rich get richer" just repeat in a Bitcoin world? Does Bitcoin really represent a challenge to that fundamental truth?

Today’s focus:

Q: “What about the distribution of wealth in Bitcoin? Isn't it even worse than in the fiat economies?”

Jason: Well, I'd say it's a little early to draw any confident, long-term conclusions, but so far things are looking good. Let's investigate what we know so far and see what we find....

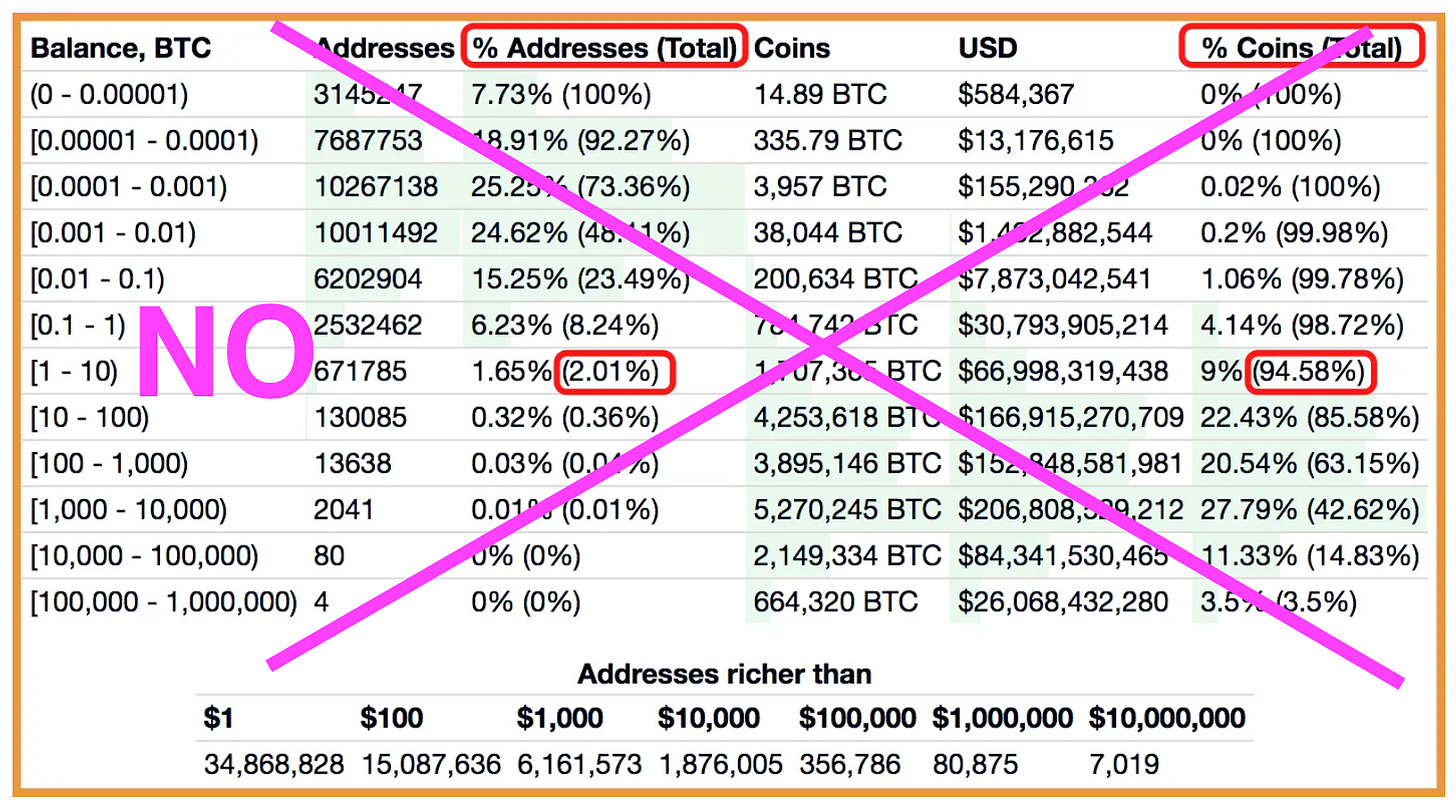

First, let's look at the kind of naive, alarmist takes that you can find in most mainstream coverage and where those numbers come from. Because it's important to know why they're misleading and flat-out wrong so you can confidently refute them when you hear them repeated.

If an unscrupulous writer wants to criticize Bitcoin or generate engagement through outrage or shock, they'll cite data based on *addresses* and say something like this:

About 2% of bitcoin accounts hold 95% of the available coins, according to Flipside, a crypto-analytics firm.

--The Economist - 6th December 2021

Numbers like this are generally derived from analyzing the table of richest addresses like this:

The problem with looking at how wealth is distributed across addresses is that one person (or entity) can have any number of addresses. (There are roughly as many usable Bitcoin addresses as there are grains of sand in the universe -- not the world, the UNIVERSE -- so we're not going to run out.) My ColdCard hardware wallet from Coinkite immediately generates 20 addresses for me to start with, and I can generate as many as I need beyond that.

Also consider that many users (hodlers) have multiple hardware and software self-custody wallets as well as multiple accounts on custodial sites and exchanges.

Then consider the recommended best practice of not reusing the same Bitcoin address as a way to increase your privacy on a public ledger. In 2018 Chainalysis estimated that 93% of Bitcoin addresses were single-use. Sure, some whales (individuals with more than 1,000 BTC) keep all their Bitcoin on a single address. But if someone like that wanted to gain some privacy or just spread out their risk, they could just choose to keep less than 1 BTC behind each of several thousand addresses. (If you're that rich, you can afford to pay someone to manage the details for you.)

On the other hand, you have "custodials", like exchanges, which represent the pooled assets of hundreds of thousands of individuals. Similarly, large-scale, publicly traded Bitcoin mining companies may hold many thousands of bitcoin, but that bitcoin is a line on the company's balance sheet, which is in turn owned by the company's many shareholders. When it comes to these mega-entities which are the aggregated wealth of hundreds of thousands of individuals, I think it's probably rather misleading to treat them as a single mega-wealthy entity. Sure, some of their customers will be mega-wealthy, but many won't. It'll be a mix, perhaps more or less like the overall distribution of Bitcoin hodlers, perhaps slightly skewed toward the wealthier end due to the world's poor being almost entirely excluded from the opportunity to participate in those financial activities.

And then you have the so-called "dormant addresses" from the early days of Bitcoin which have never spent a single satoshi, are now worth billions of dollars, and are likely lost forever due to having lost the private keys that control them. [Back up your keys!] That's about 3.4 million bitcoin that are likely gone forever, but if you think those addresses are "people" then they make it look like there are a lot more rich bitcoiners than there really are.

No matter how you slice it, considering each address to be "a person" is clearly misrepresenting reality of the situation. Addresses aren't people!

Here's an analogy to help explain the role that Bitcoin addresses play:

Bitcoin addresses are like disposable, single-use bags that you can keep your stuff in for a little while or shove into a closet for years. Some people like to keep all their cash in one bag. Some like to break it up into many bags and stash them everywhere.

We don't talk about wealth distribution in the US dollar economy by analyzing separate accounts (checking, savings, money market, 401k, brokerage, etc.). We talk about people, because when we talk about wealth distribution that's what we really want to know about.

Okay, so how do we get a handle on anything like an "entity" or "person" on the Bitcoin blockchain?

Fortunately the demand to mine useful data from open blockchains has already spawned a small industry. Chainalysis and Glassnode are among the most well known of these. They have spent a lot of time and effort analyzing patterns of transactions and combining that with available public data to extract both known and plausible "entities" on the Bitcoin blockchain. Their "address clustering" methods are the basis of many of the rest of their metrics and analyses, so they place high confidence in them and continually refine them.

Based on their analyses, the wealth distribution of Bitcoin is currently not spectacular, but it is already better than most countries and fiat currencies and getting better over time. And if that trend holds, then that is what will matter in the long run.

But let's take a tour through fiat-land first so the Bitcoin numbers land with some context....

How can we compare the wealth distribution of one economy (or asset class) to another completely different economy (or asset class)?

There's a measure for that! It's not perfect, but it works well enough for our purposes.

It's called the Gini coefficient, or just "the Gini". It's a way of boiling down wealth inequality or income inequality to a single number, where zero (0 or 0%) means perfect equality and one (1 or 100%) means maximal inequality. If you want to understand how it's calculated and its many limitations, Wikipedia is your friend, but you don't need to understand Lorenz curves to get the basic idea:

Low Gini = low inequality, which is good.

High Gini = high inequality, which is bad.

[But it's important to note that when the Gini is calculated for incomes, one can use before-tax incomes or after-tax incomes, and that those will produce somewhat different numbers depending on the tax regime of each economy or country. So, not all Ginis are comparable! Not to mention that we're currently interested in wealth distribution, not income distribution, which can be VERY DIFFERENT.]

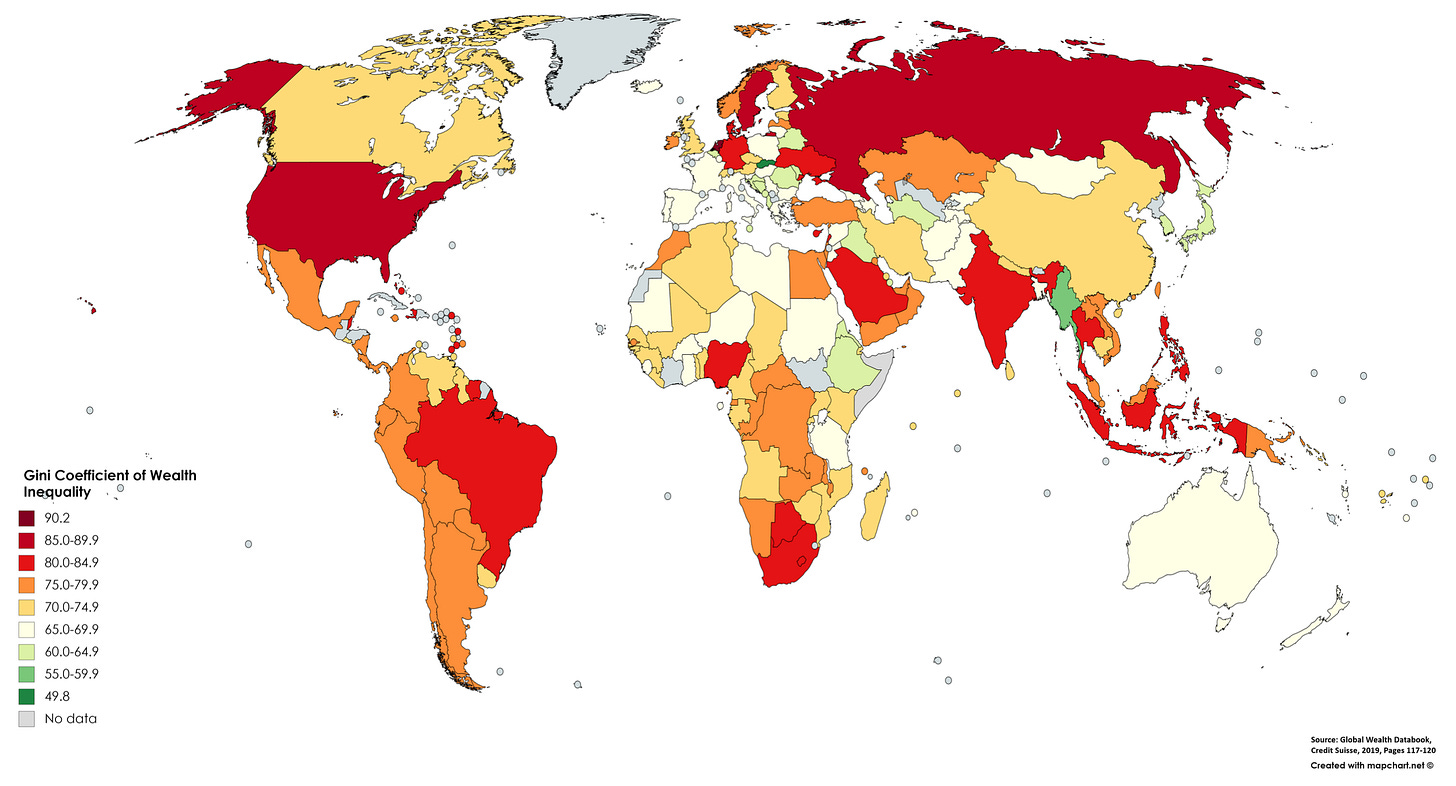

To give you an idea of where various countries fall for wealth inequality along the Gini scale, here's a world map as of 2019:

Note that almost all countries' Gini coefficients fall in the range from about 60 to 90[%], and only a handful are in the 50s. The U.S. is at the high end [shocker], in the upper 80s. There are essentially no countries with a Gini below 55. (Great job Slovakia, though, wow!)

Now that you have some idea what these numbers correspond to in the world of fiat money wealth inequality, let's see how Bitcoin fares....

I got a lot of this information from this excellent and comprehensive blog article by Michael Weymans. So, thanks to him for pulling all of this research together. I'm boiling it down even further here, skipping over some of the details. If you want to read an even longer essay on this topic, I highly recommend that article.

Weymans first cites a research article from 2021 titled “Characterizing Wealth Inequality in Cryptocurrencies” by Sai, Buckley, and Le Gear. Their methods are complicated, I haven't reviewed them thoroughly, and I'm sure they could be picked apart and criticized, but here's what they ultimately came up with for one way of calculating Bitcoin's Gini coefficient over time:

--Sai, Buckley, and Le Gear, 2021, Figure 4B

You can see that starting after its first year (2009), it started near the high end over 0.8 (80%), but was below 0.5 (50%) by 2021, and that the overall trend is down.

A blockchain forensics company called Cylynx came to a similar conclusion in January, 2021:

--source

Again, Bitcoin's Gini starts 2010 over 0.8 and ends 2020 below 0.5 with the overall trend being down.

The exact number will vary wildly based on how you cluster addresses into entities and what minimum balance you choose and dozens of other choices. Today's Gini coefficient for Bitcoin could be anywhere from 0.48 to 0.73.

I think there are a few important things that we can take away from this, however, regardless of which method is used:

Bitcoin's wealth distribution is not entirely different from that found in fiat money economies around the world.

Bitcoin's wealth inequality is NOT 99%+, as some have claimed.

Bitcoin's wealth inequality is DECREASING.

And that's more than you can say for fiat economies and most shitcoins.

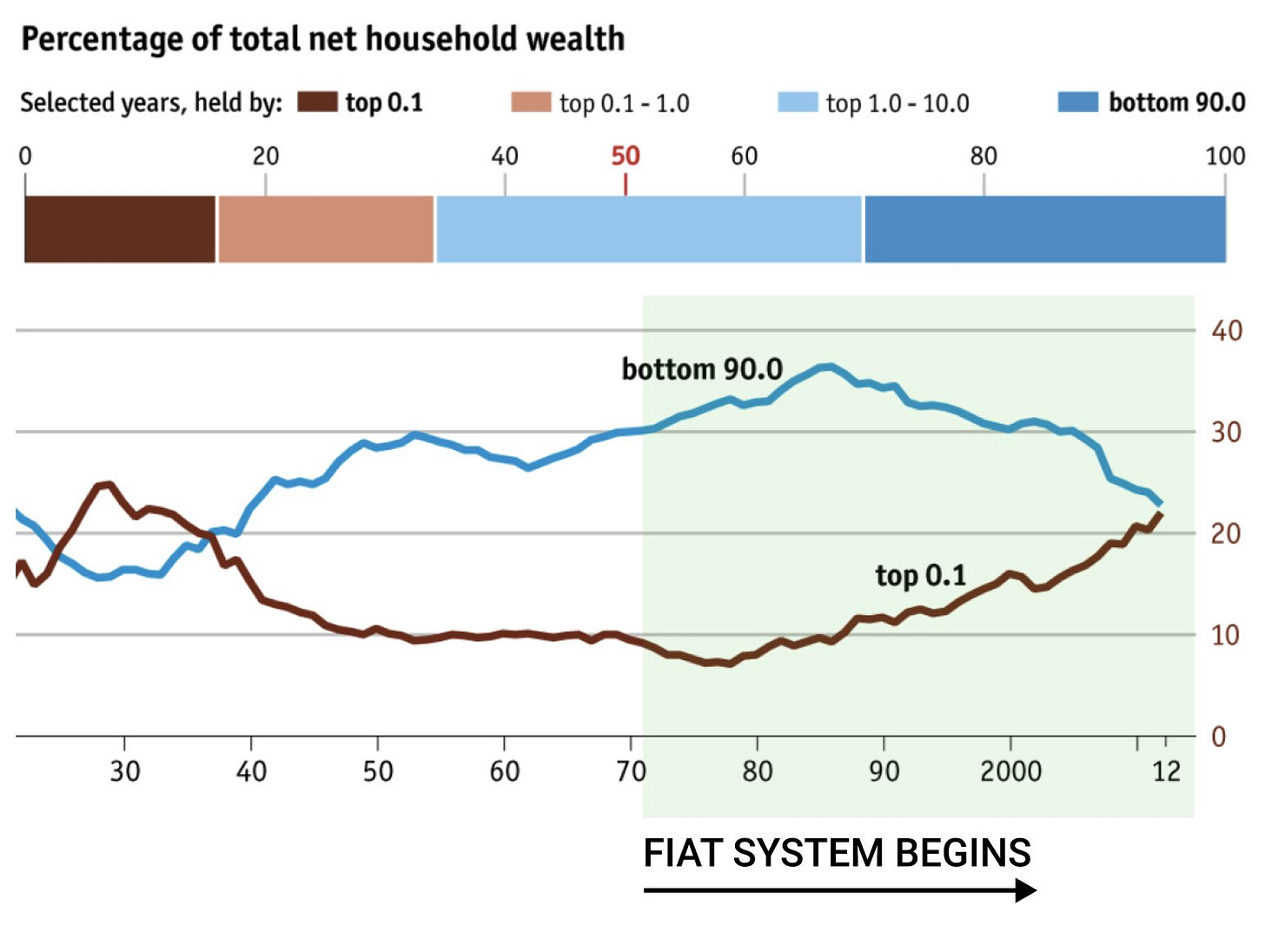

Willy Woo posted this annotated graph in January, 2022...

-- "A history of American wealth inequality", The Economist, Nov. 2014

From the mid-70s to 2012, the top 0.1% (one tenth of one percent) of Americans went from holding just 8% to around 22% of all household wealth. During the same time, the bottom 90% of Americans went from holding about 34% to just 23% of household wealth.

But is a similar dynamic playing out in Bitcoin? The Gini coefficient can obscure reality by boiling the complexity of inequality to a single number.

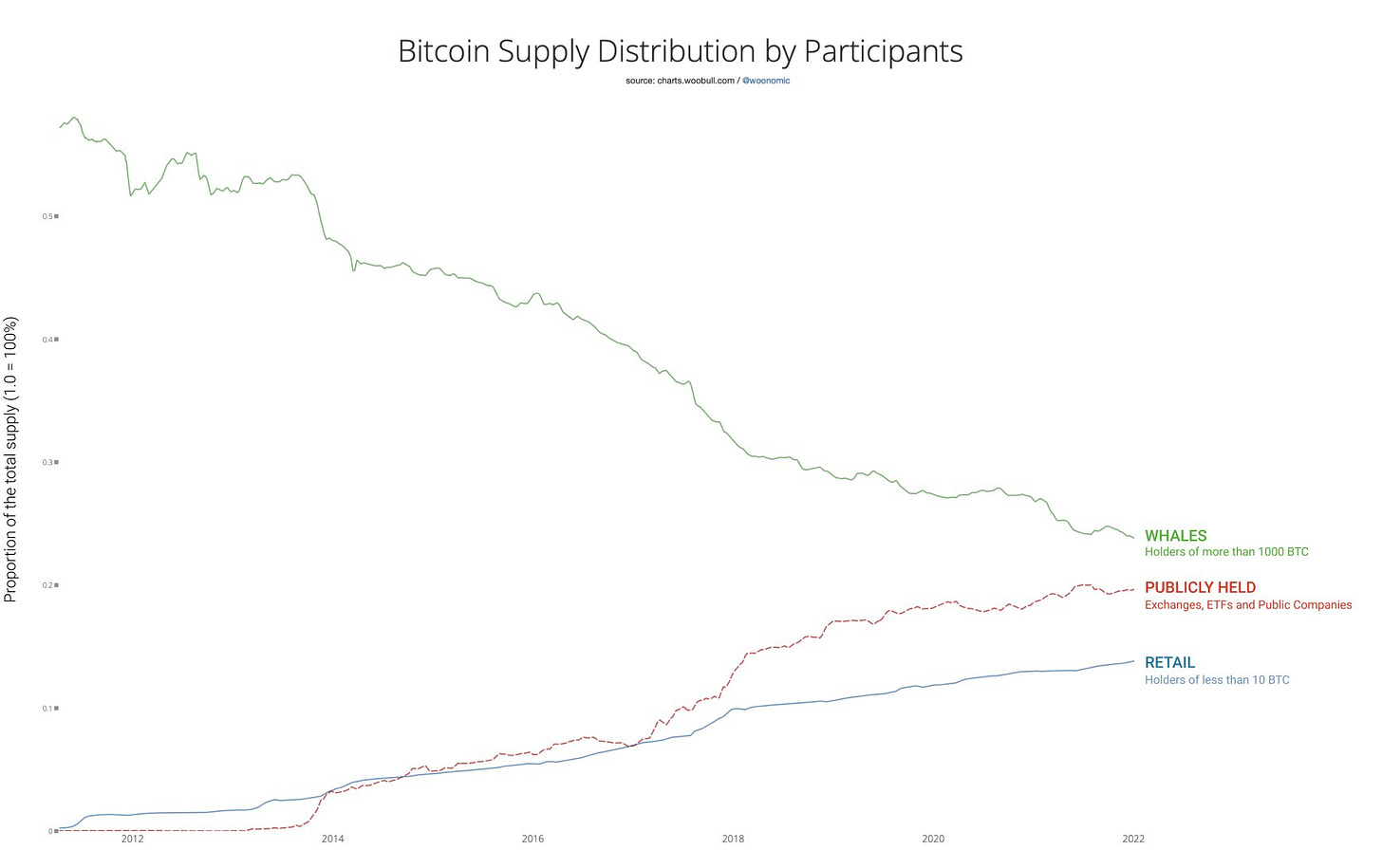

Willy Woo also provided us (from his own work) a look at the trends between whales and "retail" (shrimp and crabs, i.e. you and me):

From 2011 to 2022, the whales have gone from holding over half of the total Bitcoin supply to holding about 25%. During the same period, retail hodlers (using self-custody) have gone from having effectively zero bitcoin to holding about an eighth (~12-13%) of total Bitcoin supply and the general public, which includes both rich and poor, has gone from zero to around 20% of total Bitcoin supply.

I'm not sure if it'd be right to lump the general public and retail together, because there are undoubted some extremely wealthy people holding BTC through exchanges, ETFs, and public companies. (Which is probably why Willy didn't do that.) So, that's a 20% chunk of the Bitcoin supply that is kind of a big gray question mark.

But here's a visualization from Glassnode showing the full range of hodler cohorts as well as miners and exchanges:

-- Glassnode

As the lighter colored bands consume more of the vertical space, Bitcoin's supply is becoming more evenly distributed. Or as Glassnode put it, "the (relative) amount of BTC held by smaller entities has been growing over the course of Bitcoin's lifetime."

What is unquestionable to me is the overall trend, which is that retail (working class plebs like you and I) are holding a greater and greater portion of the total Bitcoin supply, which is exactly the OPPOSITE of what The Economist pointed out was happening with American household wealth over the last few decades.

So whether or not you believe that Bitcoin's wealth distribution is currently more unequal, about the same, or less unequal than your favorite fiat economy, it seems irrefutable to me that Bitcoin is becoming less unequal over time while fiat is becoming more unequal.

In the long run, which system would you like to live in?

But why should it be, you might wonder, that Bitcoin should behave differently from fiat money economies when it comes to wealth distribution over time?

I think it comes down to two things. The first is Bitcoin's fundamental distinguishing feature, which is that its supply is absolutely limited. It can never be changed to allow for more than 21 million bitcoin to ever exist. The second is that the world has so far continued to recognize Bitcoin as the best digital store-of-value asset in the world and to buy it more than any other.

Why would the limited supply matter?

In a fixed-size currency system, as wealth circulates, those who choose not to sell automatically benefit as more people enter the system (as the asset becomes "monetized"). If new entrants could simply be given new supply, then the price wouldn't have to go up to absorb them.

Meanwhile the entire reason for the existence of fiat money is precisely to allow the governments that issue them to create more at will, to "grow" the economy. (It's right there in the name: "fiat" -- meaning "by decree".)

Add to this the Cantillon effect, by which those closest to the proverbial money printer (the big banks, Wall Street, government elites, etc.) enjoy most of the benefits from any new money that comes into being.

So you can hopefully see how the fiat system would generally tend to enrich the already wealthy.

Whether Bitcoin will ultimately take on a rich-get-richer behavior is an open question, though. No one knows. The way things are going here in the early second decade of Bitcoin's existence, I like the trend. But Sai et al. also produced Ginis over time for 6 other Bitcoin-like open blockchains and most of those didn't fare as well:

--Sai, Buckley, and Le Gear, 2021, Figure 3A

Hence my inclusion of a second factor in Bitcoin's relatively low inequality: its dominance within the entire cryptocurrency asset class. (Depending on whether you include stablecoins or not, Bitcoin currently commands around 40% or 60% of the entire crypto market.) I imagine it works like this: Because the world at large has invested and continues to invest more of its collective stored wealth into Bitcoin than into any of its copycats, and so it has the best risk-adjusted returns (Sharpe ratio) of all the cryptos, and because rational investors are rewarded for periodically "taking profits" by selling some small portion of their bitcoin for fiat money (to pay bills, diversify, etc.), Bitcoin's supply is gradually being redistributed from older, wealthier hands to newer, less wealthy hands.

But if we look at the other "Bitcoin-like" cryptos, they have much less global wealth invested, are higher risk, and so whales can more easily amass huge stacks and manipulate the price, easily siphoning wealth from the hands of retail.

If this analysis is correct, this points to a couple of warnings.

1) If there were for some reason a general exodus from Bitcoin, I would predict that the supply would generally become and remain more concentrated, like what happened with Bitcoin Cash and Litecoin. That is NOT what is happening, though, so this is good news for the current trend. As long as Bitcoin's broad adoption and dominance continues within the current fiat-dominated system -- and I see no reason why it shouldn't -- Bitcoin's Gini will most likely continue to trend favorably... however....

2) Once we pass beyond the inflection point and enter a period of hyperbitcoinization -- where the entire world starts racing to buy any bitcoin they can get at almost any price in (hyperinflating/worthless) fiat -- then rational investors will no longer have a strong incentive to periodically sell a small portion of their bitcoin. (If you already hold what is universally recognized as the world's most desirable asset, what would you sell it for when you could just borrow against it??) So if you believe that hyperbitcoinization is coming, this implies that we are currently in a time-limited period of Bitcoin wealth redistribution. Once the music stops, the ones with a chair to sit in will more or less have been determined.

What about the bitcoin that haven't been mined yet? Couldn't the wealthy get most of that?

I don't think the mega-rich can monopolize Bitcoin mining capacity. First, only about 9.5% of the 21 million bitcoin that will ever exist are left to be mined. Second, the programmed halving of the issuance every four years ensures that mining effort yields less and less bitcoin over time (900 bitcoin per day now, 450 per day starting in 2024, 225 per day starting in 2028, etc.). Finally, the mining difficulty adjustment every two weeks ensures that no one can quickly overwhelm the network with mining capacity by making a sudden investment.

The only credible threat here would be if countries started commandeering any known (or detectable with heat signatures) bitcoin mining facilities within their borders for "national security" interests. This would of course be an extreme situation, but it illustrates the importance of mining at home and of not allowing mining to become concentrated within one political jurisdiction.

Let's return again to the fundamental driving force behind Bitcoin: adoption. Because this provides one of the main clues to Bitcoin's falling Gini.

As you can imagine, the majority of Bitcoin adoption around the world is happening in places...

where people are desperately fleeing their collapsing, extortionate currencies for anything that will hold value,

where the traditional banking system fails to serve most people (because reasons),

and where there is enough internet connectivity and personal savings to allow for adoption to spread rapidly.

No surprise then that bulk of Bitcoin adoption so far has been in lower-middle- and upper-middle-income countries:

--Financial Times article [behind paywall] [archived Sept. 2021]

[Note: El Salvador's national Bitcoin wallet program only launched in September of 2021 when the above FT article was published. If this chart were redone now, it would surely be included.]

But global adoption trends could change. If the global rich were to decide to pile into Bitcoin relatively quickly, it would of course drive the price sky high, but it could also reverse the current trend and cause a larger and larger portion of the total supply to move into the hands of the wealthy.

So from that perspective I think it's absolutely wonderful that Wall Street still thinks Bitcoin is a "risk asset" and sells it when they get scared. More time for the workers of the world to stack cheap sats and spread the word!

I hope that I've provided a decent picture of what's going on with Bitcoin's wealth distribution without getting too far into the weeds.

Of course there's an entire rabbit hole to explore. If you want to learn more about this topic, I'd start with Michael Weymans' blog article and this Glassnode page. And if you're interested in the wider social justice angle on Bitcoin, Alex Gladstein's content is where it's at.

If you have any questions, criticisms, or requests, please let me know.

Stay humble. Stack sats.

— Jason